We all make mistakes, and yes, I messed up with my credit card. But the silver lining is that you can learn from my mistakes. You don’t have to go through that same heartache.

Learn from my experience and the lessons it taught me – this will help you manage your credit card wisely.

I often advise my clients to pay their credit card balances in full. Ironically, this time I didn’t follow my own advice. Here’s the story:

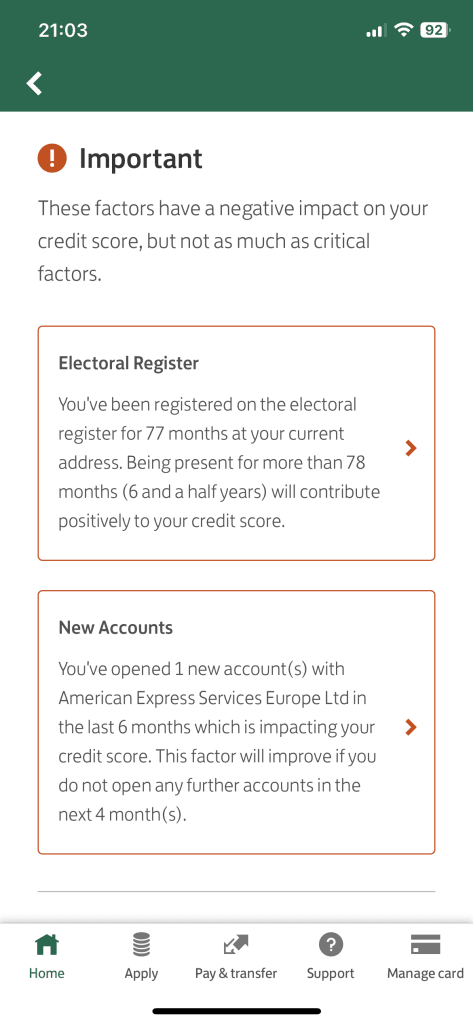

In my quest to find smarter ways to both make and spend money, I decided to try out a new card that offered some rather good benefits. It was an upgrade from the same provider. Excited to make the most of these benefits, I started spending on the card without going through my usual due diligence.

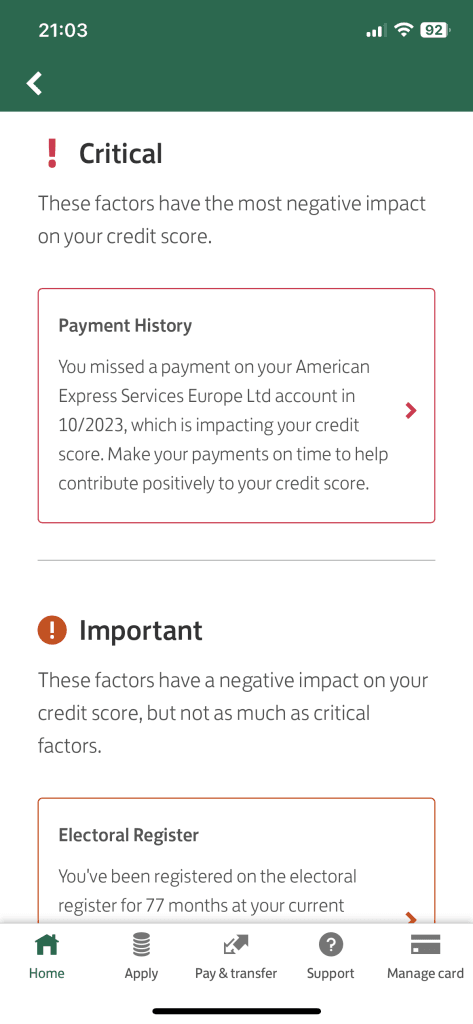

Historically, I have always paid my credit card bills in full through direct debit. However, I overlooked the fact that despite this card being from the same provider, I still needed to set up the direct debit order.

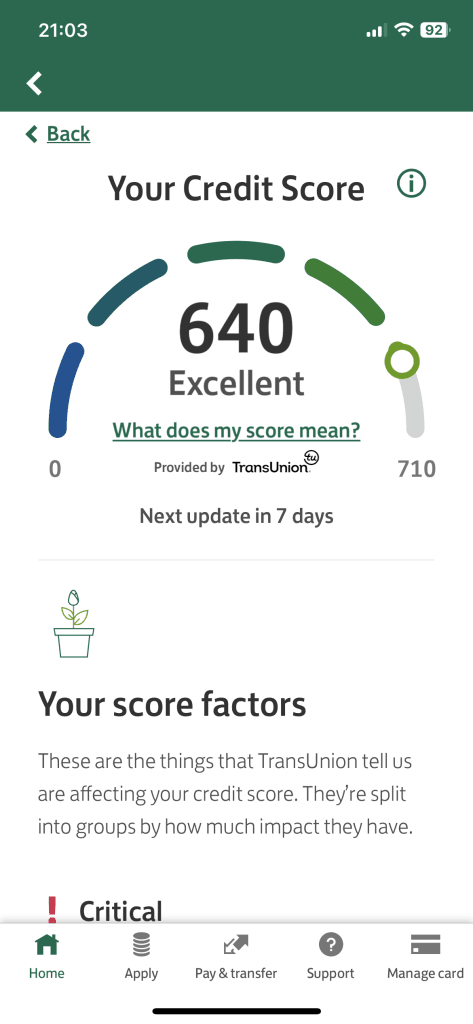

The oversight came back to haunt me when I casually checked my credit card balance and saw it in red with a red note stating that the payment was overdue. Panicking, I promptly paid the full bill.

Unfortunately, the damage was done: interest fees and late payment charges had already been applied. So much for benefits: now all I was seeing were forfeits.

To prevent you from falling into the same trap, here are some key lessons:

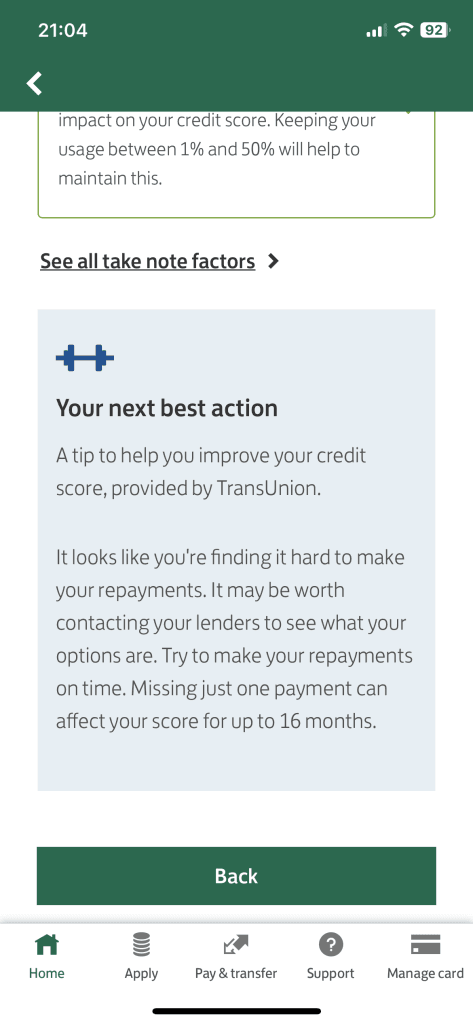

💳 Direct debit on every card

Ensure you set up direct debit for each of your credit cards, old and new, to avoid missing payments and incurring fees.

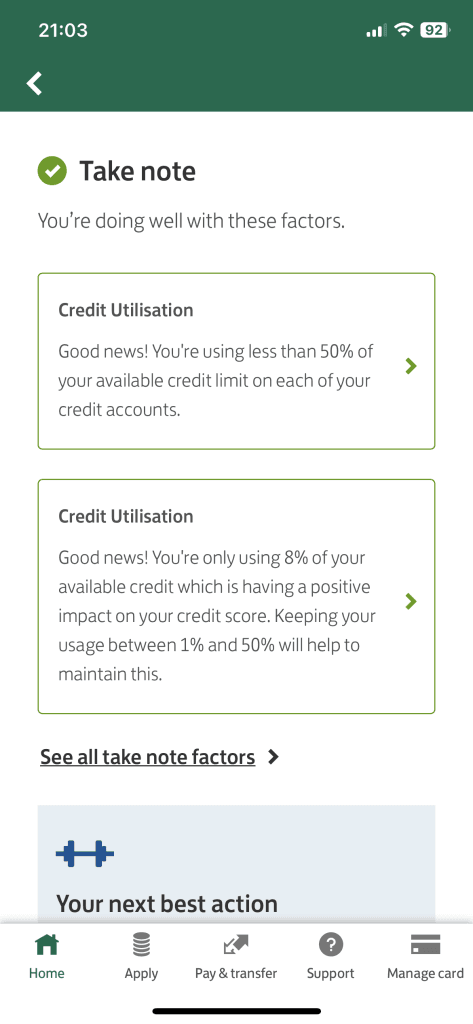

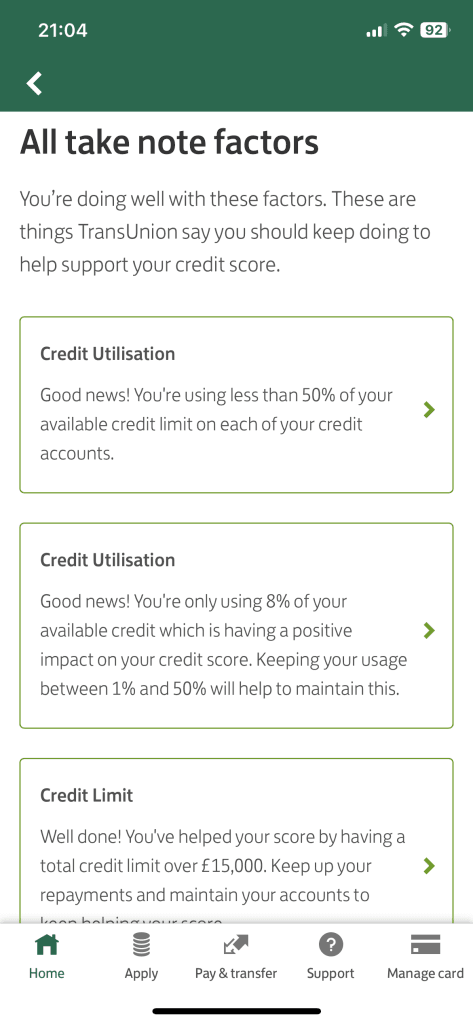

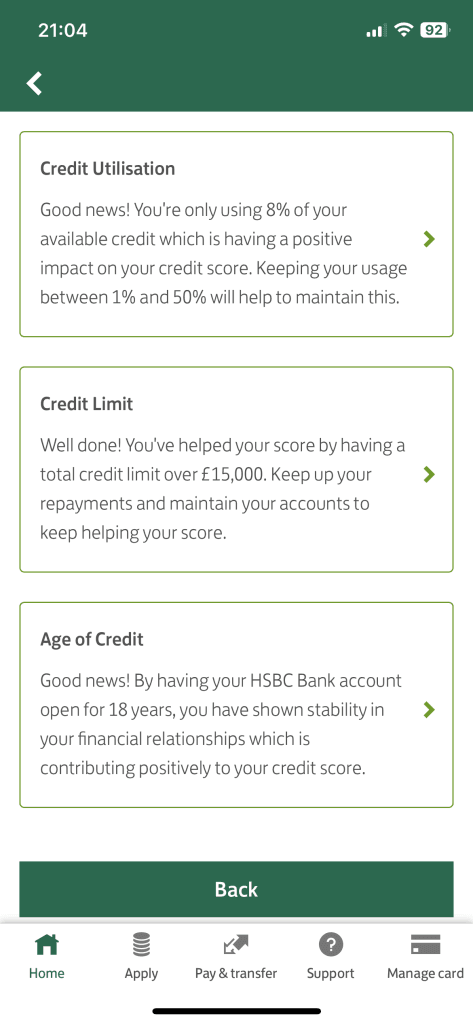

💳 Credit utilisation

Never use more than 50% of your credit card limit. Exceeding this threshold may make the bank question your reliability as a borrower, which could then negatively impact your credit score.

💳 A card that fits your lifestyle

Make sure your credit card offers benefits that align with your lifestyle and spending habits. It’s not just about having a card; it’s about having the right one.

💳 Always pay the full balance

To avoid interest fees and late payment charges, commit to paying your credit card balance in full each month. It’s a simple yet crucial rule.

💳 Use comparison websites

Explore comparison websites to find the credit card that best suits your needs. Compare interest rates, rewards, and fees to make an informed decision.

💳 Are you eligible?

Before applying for a credit card, conduct an eligibility check to gauge your chances without affecting your credit score unnecessarily.

This wasn’t a wholly bad experience. I called the credit card provider and told them I’ve always been a great customer and paid all my bills on time, I don’t deserve being penalised for this once-in-a-lifetime mistake. After 3 weeks and a few internal emails between departments, they finally agreed to refund me my £86 in late payment and interest charges.

💡Here is a bonus tip

Never ignore your creditor. If you owe money or have made a mistake, admit it and you might be given another chance. If you don’t ask, you won’t get.

Learn from my credit card mishap and adopt these practices to manage your credit wisely. By setting up direct debit, controlling your credit utilisation, choosing the right card, paying your balance in full, using comparison websites, and checking eligibility, you can navigate the world of credit cards without the stress of unexpected fees and charges.

Do you want to learn how to make better financial decisions including managing your credit card?

Buy a copy of the Master Money Plan today!

———

About Master Your Finances

Master Your Finances helps to make money matters simple for everyone. This mission is guided by the principle that you are the best person to make decisions about your own personal finances.

Built on three central pillars of self-responsibility, simplicity and independence, Master Your Finances focuses on empowering people to save, manage and grow their money in the UK.

Through founder and managing director Leticia Fonseca, Master Your Finances has helped thousands of individuals master their finances through guidance on how to:

- Get out of debt

- Organise their finances and start budgeting

- Invest in the UK

- Boost their retirement savings

Master Your Finances offers services and structures to suit a variety of needs:

- Personalised one-to-one financial wellbeing sessions

- On-demand money management courses

- Group workshops

- Group mentoring programmes to start investing in the stock market

- Financial well-being awareness seminars

Find more information at masteryourfinances.co.uk